Ah, passive income – the dream of many a financially savvy individual. The idea of making money while you sleep or sip margaritas on a beach somewhere sounds pretty darn appealing, doesn’t it? But can passive income actually come to the rescue when your active income takes a hit? Let’s dive into this juicy topic and explore some strategies for achieving financial stability.

First things first – what exactly is passive income? In a nutshell, it’s money that comes in regularly without you having to actively work for it. This could be from rental properties, investments, royalties, or even online businesses. The beauty of passive income is that it can provide a cushion for those inevitable times when your active income isn’t flowing as smoothly as you’d like.

So, can passive income really help offset active losses? The short answer is – absolutely. Having multiple streams of income, both active and passive, can provide a level of financial security that can weather the storm of job loss or unexpected expenses. It’s like having a financial safety net that catches you when you fall.

But how do you go about creating passive income streams? Well, the options are virtually endless. You could invest in the stock market, start a dropshipping business, write an e-book, or even create a popular YouTube channel. The key is to find something that aligns with your skills and interests, so that you can enjoy the journey to financial stability.

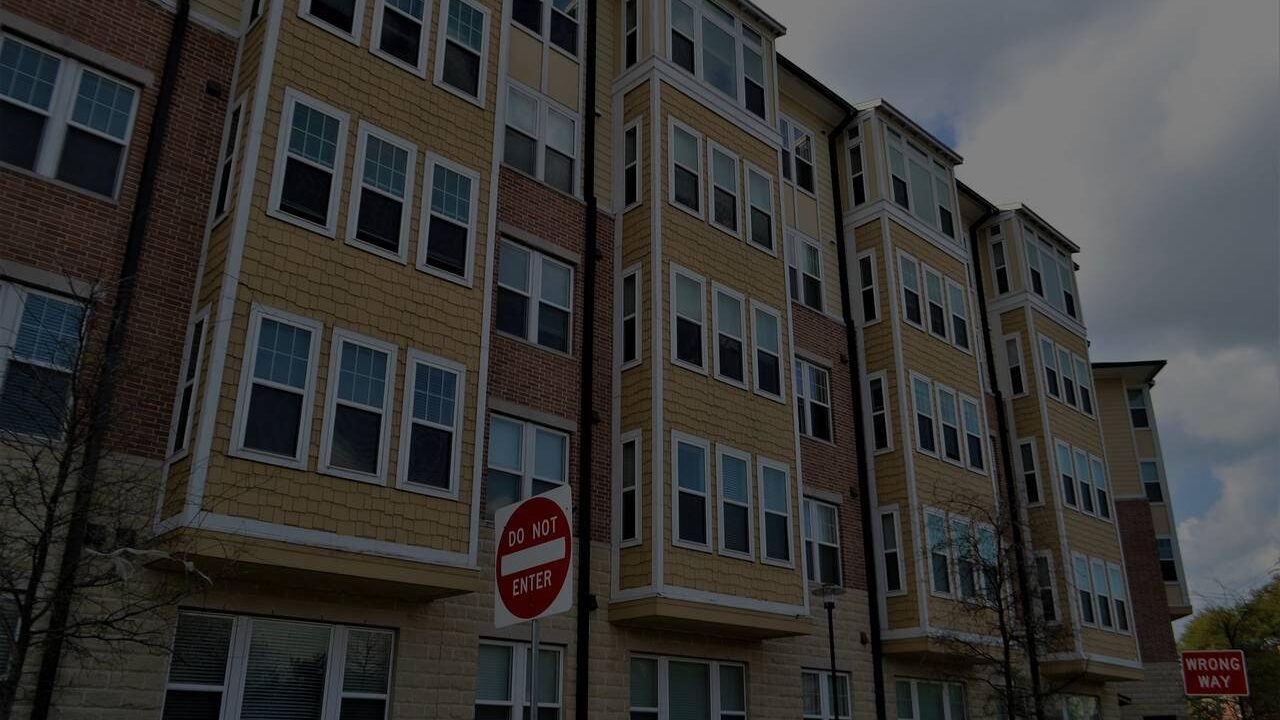

One great way to start building passive income is through real estate investment. Rental properties can provide a steady stream of income that can help offset any losses from your day job. Plus, real estate has the added benefit of appreciating in value over time, making it a smart long-term investment.

Another popular passive income strategy is investing in dividend-paying stocks. By purchasing shares in companies that distribute a portion of their profits to shareholders, you can build a portfolio that generates regular income without you having to lift a finger. It’s like having a little money tree that just keeps on giving.

Of course, creating passive income isn’t a magic bullet for financial stability. It takes time, effort, and a bit of risk-taking to build a portfolio of income-generating assets. But the rewards can be well worth it, providing you with the peace of mind that comes from knowing you have multiple streams of income to rely on.

So, if you’re looking to shore up your financial stability and protect yourself from the ups and downs of the economy, consider exploring passive income opportunities. Whether it’s through real estate, investments, or online businesses, there’s a world of possibilities out there waiting for you to explore.

And hey, if you’re looking for more tips and tricks on how to achieve financial stability through passive income, be sure to check out vanturas.com. We’ve got a treasure trove of resources to help you on your journey to financial freedom. Happy reading, and may your passive income dreams become a reality!