Getting Started with Personal Budgeting: A Beginner’s Guide

Hey there, budget buddies! So, you’ve finally reached the point where you’re ready to take control of your finances and start budgeting like a pro. Congratulations! You’ve taken the first step towards financial freedom, and let me tell you, it’s going to be a game-changer.

Now, before you start hyperventilating at the mere mention of the word “budget,” take a deep breath. Budgeting doesn’t have to be boring or stressful. In fact, it can be downright empowering and dare I say, fun! Yes, I said it – budgeting can be fun. Just roll with me on this one.

First things first, let’s talk about the importance of personal budgeting. Picture this: you’re standing at a fork in the road, with one path leading to financial chaos and the other to financial nirvana (yes, that’s a thing). Which path would you choose? I’m guessing the latter, right? Well, my friend, that’s where budgeting comes in. It’s the roadmap that guides you towards your financial goals and helps you avoid the dreaded land of debt and regret.

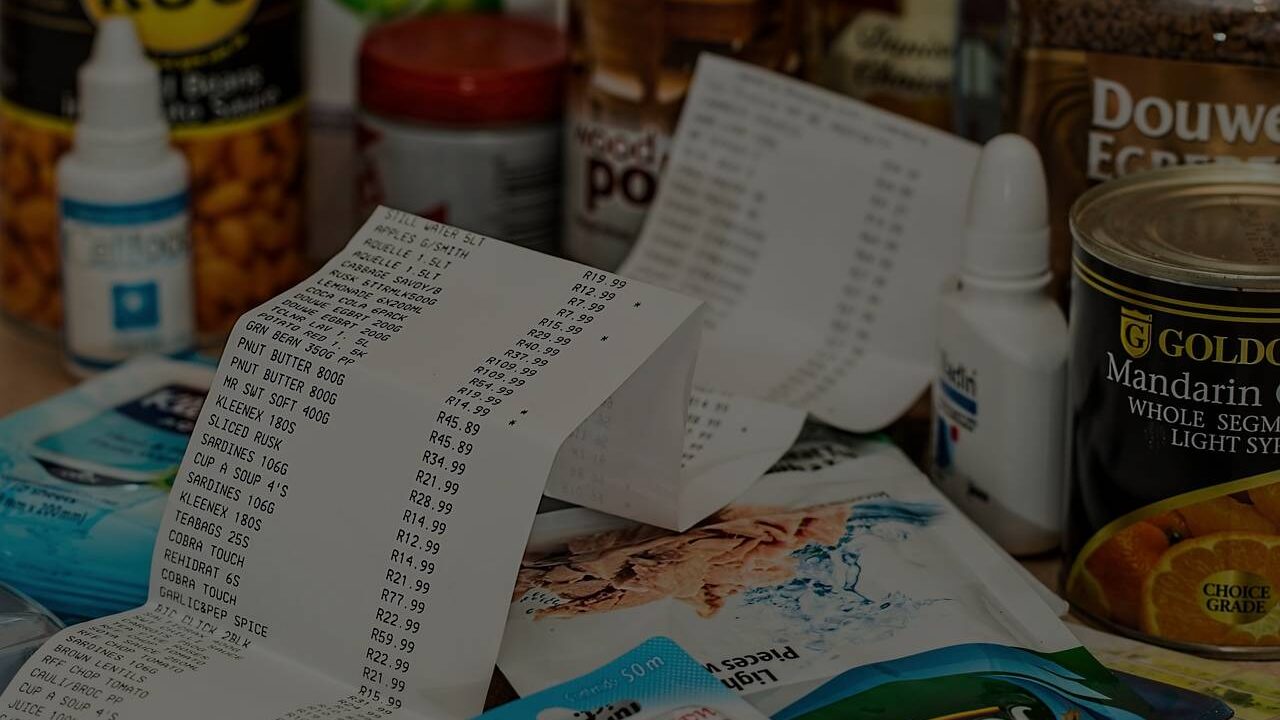

Now, let’s get down to the nitty-gritty. Grab a pen and paper (or your trusty smartphone) and let’s start creating your first budget. The key to successful budgeting is tracking your income and expenses. Make a list of all your sources of income – your salary, side hustle gigs, birthday money from Aunt Edna, you name it. Next, jot down all your monthly expenses – rent, groceries, Netflix subscription, avocado toast addiction, you get the idea.

Once you have a clear picture of where your money is going, it’s time to set some financial goals. Do you want to save up for a dream vacation, pay off your student loans, or maybe splurge on that designer handbag you’ve been eyeing? Whatever your goals may be, having a budget in place will help you achieve them faster than you can say “I’m a budgeting boss.”

Now, let’s address the elephant in the room – the dreaded “B” word. Yes, we’re talking about budget cuts. But fear not, my frugal friend. Cutting back on expenses doesn’t mean sacrificing all the things you love. It’s about making smarter choices and prioritizing what’s truly important to you. So, say goodbye to that daily Starbucks run and hello to brewing your own coffee at home. Trust me, your wallet will thank you.

And speaking of saving money, have you heard about Vanturas.com? It’s your one-stop shop for all things budgeting and finance-related. Whether you’re a seasoned budgeting pro or a newbie just dipping your toes into the world of personal finance, Vanturas has got you covered. From budgeting tools and resources to expert advice and tips, Vanturas is here to help you reach your financial goals and live your best money-smart life.

So, there you have it, budget beginners. Getting started with personal budgeting doesn’t have to be intimidating or overwhelming. With a little bit of planning, a sprinkle of discipline, and a dash of budgeting know-how, you’ll be well on your way to financial success. Remember, Rome wasn’t built in a day, and neither will your budget be. But with perseverance and a positive attitude, you’ll be counting your savings in no time.

Until next time, keep on budgeting, stay fabulous, and don’t forget to visit Vanturas.com for all your budgeting needs. Happy budgeting, folks!